Ukrainian platform Limitless, founded by Reface co-founders Roman Mohylnyi and Dmytro Horshkov, has raised $10 million in a seed round.

This was reported by Scroll.media.

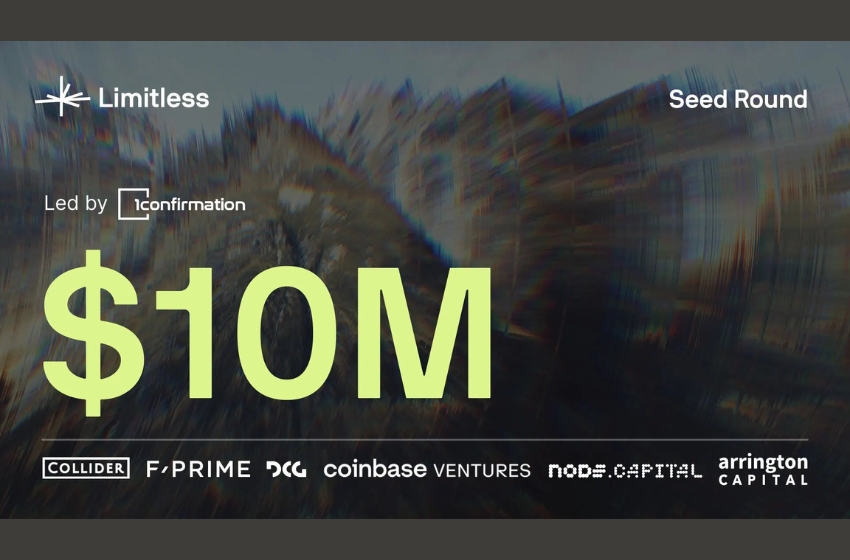

Investors in the new round include 1confirmation, Collider, F-Prime, DCG, Coinbase Ventures, Node Capital, Arrington Capital, as well as Ukrainian venture funds SID Venture Partners and Flyer One Ventures. The new investment round comes just four months after the previous one, in which Limitless raised $4 million in June 2025. In total, the startup has now received $17 million in funding, including a previous $3 million pre-seed round.

The company plans to use the funds to accelerate product development, launch new services, and attract more users. In recent months, Limitless has shown rapid growth: trading volume on the platform has exceeded $508 million, nearly double the figures from summer 2025. Additionally, in just the first half of October, the company surpassed the results of the entire September, highlighting dynamic user activity growth.

Interest in the platform is also increasing due to plans to launch its own LMTS token, which is expected to become part of the Limitless ecosystem. Limitless operates as a prediction platform, where users can create events and place bets on their outcomes — for example, whether Google’s stock price will exceed a certain level or whether the cryptocurrency XRP will reach a specific price by a set date.

Limitless is not a bookmaker, but rather a platform connecting users with each other. Experts note that the prediction market sector is rapidly growing: similar companies such as Polymarket and Kalshi have already reached billion-dollar valuations. Polymarket reached a valuation of $9 billion after raising $2 billion from Intercontinental Exchange, while Kalshi is valued at $5 billion following investments from Sequoia Capital and Andreessen Horowitz.