Metinvest group is investing $44 million in solar and gas engine power generation, and by 2030 the company plans to cover 50% of its needs with its own generation. This was reported by Forbes Ukraine.

On April 15, the company launched its first gas engine power plant — four units with a total capacity of 10 MW from the Turkish company Dalgakiran, which will strengthen the energy security of the Kametstal steel plant. Overall, the enterprise requires up to 150 MW, said Metinvest’s Chief Operating Officer Oleksandr Myronenko.

By the end of May, Metinvest plans to launch another 19 MW of gas engine units at the Northern and Central mining and processing plants. The steel plants installed four units from Jenbacher (total capacity 11 MW) and Cummins (8 MW) respectively. They will be put into operation soon after test runs.

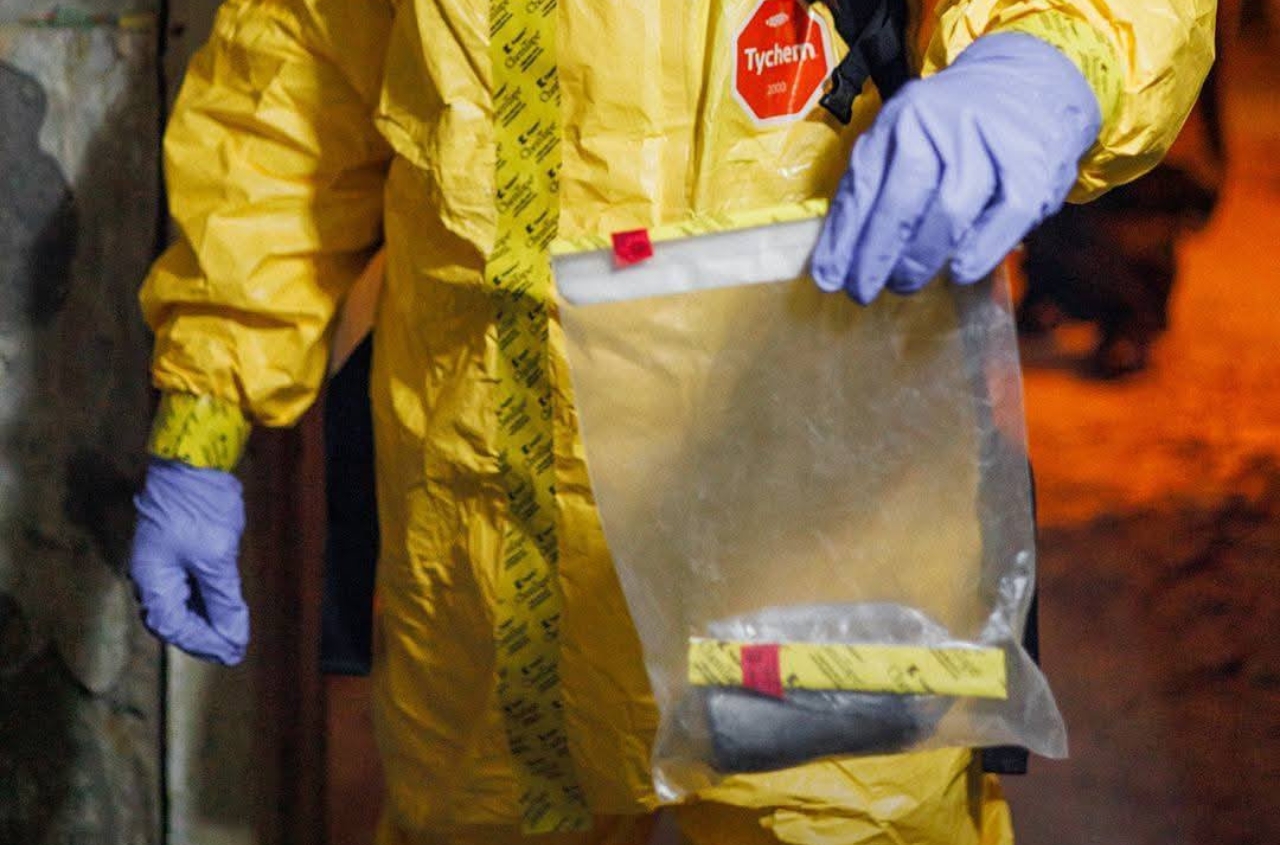

Infrastructure preparation included road construction, building concrete platforms, installing transformers and new electrical equipment, and gas supply. Security factors were also considered — protection against shelling was built, and the units were additionally dispersed.

Total investment in gas generation in 2025 will amount to $26 million. In 2025–2026, the group plans to invest $18.1 million in 37 MW of solar power plants at the Central mining and processing plant and Kametstal.

Oleksandr Myronenko noted that under favorable conditions the company could achieve 50% energy independence within three to four years. This primarily requires a favorable investment climate and favorable loans. It will also depend on external factors, including the course of the war. Currently, the company is developing a strategy for the energy mix and project costs. Metinvest’s consumption in 2024 averaged 672 MW, while in 2021 it was 1405 MW.

Solar generation will help reduce Metinvest’s carbon footprint, but not as much as equipment modernization and the transition to electrometallurgy. The carbon factor is important for metal export companies to the EU, since starting in early 2026 they will have to pay a border carbon tax under the CBAM mechanism.

The share of nuclear and renewable energy in the structure of the Ukrainian energy system has increased due to Russian attacks on thermal power plants. However, according to Oleksandr Myronenko, companies need time to meet EU standards. He expressed a wish to postpone Ukraine’s CBAM obligations by 3–5 years, considering the war.

Metinvest plans to switch to electrometallurgy after the war ends — this will take 7–8 years and $8 billion.

As for the group’s foreign enterprises, Metinvest currently sees no reason to develop their energy independence due to the availability of stable power supply. However, the company together with DTEK is considering building a solar power plant on the territory of the Bulgarian Promet plant with the prospect of selling electricity. The timing is currently unknown, negotiations are ongoing.